Bringing It All Together

Why VFD Pro was built, and why financial leadership needs more than reporting

VFD wasn’t designed to produce better reports.

It was designed to create better financial leadership conversations.

The problem we’re trying to solve

Why reporting alone was never enough

Every year, hundreds of thousands of businesses are created with ambition, energy, and intent. Most survive the early years, but far fewer go on to deliver meaningful long-term outcomes for their owners.

The challenge isn’t effort, and it isn’t access to data. Most businesses today have more information than ever before. What’s missing is a joined-up financial framework that helps owners understand what matters, prioritise decisions, and stay focused on where they’re heading.

As a result, many businesses drift. They trade, they report, and they comply; but without a clear financial narrative that connects performance, direction, and long-term value.

This is why so many businesses are ultimately wound up, marketed but never sold, or sold below their true potential. Not because they couldn’t have succeeded, but because they lacked the financial leadership structure to guide them there.

Most businesses don’t fail because they lack data.

They fail because they lack a joined-up financial framework to guide decisions.

Mark Walker explains why VFD was developed.

One framework. Different levels of support.

Businesses don’t stand still. They grow, stabilise, change direction, and eventually, whether by design or circumstance, move towards an exit. At each stage, the role of finance changes. The questions being asked change. The level of support required changes. What shouldn’t change is the framework being used to guide decisions.

Every business needs financial leadership

Not every business needs a full-time CFO.

Some businesses need regular, hands-on financial leadership. Others need lighter-touch support, applied at the right moments. Many sit somewhere in between, moving back and forth as circumstances change.

VFD was designed to support this reality.

Rather than forcing businesses into fixed service models or static reporting structures, VFD provides a consistent financial framework that can be applied at different depths, depending on what the business actually needs at that point in time.

This is what allows VFD to work equally well across practices, fractional roles, and teams operating at different levels of engagement.

Consistency of framework creates clarity.

Flexibility of application creates value.

“The role of finance changes as a business evolves.

The framework guiding decisions shouldn’t.”

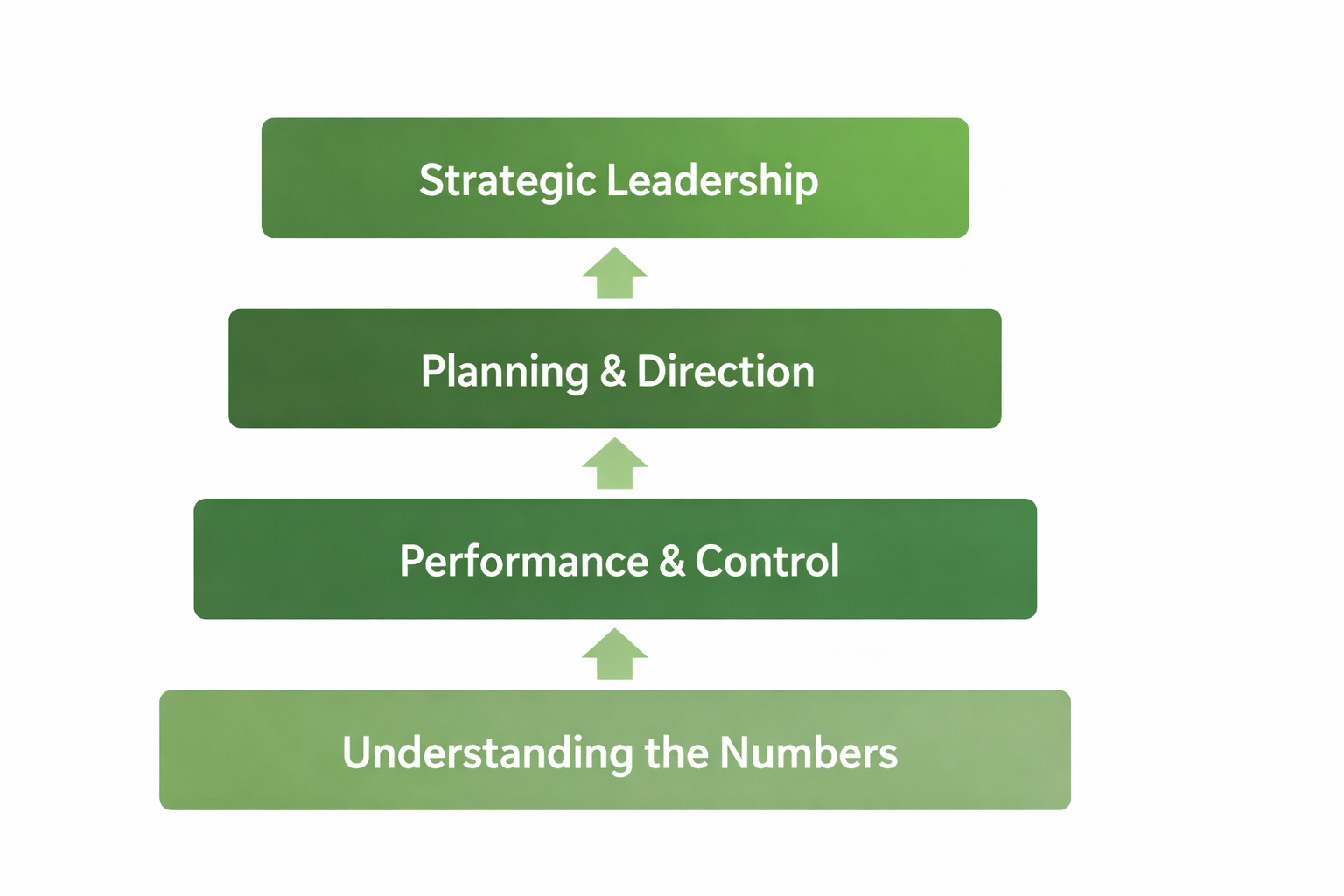

Why VFD starts with education

Financial insight only creates value when it’s understood. Without context, confidence, and a shared financial language, even regular reporting rarely leads to better decisions.

VFD was designed to address this problem at its root.

Before better decisions can be made, understanding has to come first.

Education gives business owners clarity around what matters; why the numbers matter, which metrics deserve attention, and how financial performance links to day-to-day decisions.

It creates a common language between the business owner and their finance support, making future conversations more focused, commercial, and productive.

Education changes how conversations happen.

This is why education sits at the foundation of the VFD framework, not as an optional extra.

Once business owners understand why the numbers matter, it becomes possible to show them what the numbers are really saying about their business.

Why education sits at the foundation of effective financial leadership.

From understanding to informed conversation

Education builds understanding. The next step is turning that understanding into clarity about what’s actually happening inside the business. This is where it matters, not as data-heavy reporting, but as a clear, consistent view of performance that guides attention to what matters most, and why, supporting better conversations and more confident decisions.

VFD was designed to bridge this gap.

Insight should prompt better questions, not longer explanations.

Rather than overwhelming business owners with detail, VFD focuses on presenting the information that matters most. Clearly, consistently, and in context.

The objective isn’t to explain every number. It’s to highlight what deserves attention and why.

This creates a shared reference point for conversations between business owners and their finance support. Grounding discussions in facts, not assumptions.

By presenting performance at the right level, trends become easier to spot, issues surface earlier, and conversations become more focused and productive.

Crucially, this insight can be delivered at a frequency that reflects the relationship and the quality of the underlying data; monthly, quarterly, or annually.

The framework stays the same. The frequency adapts.

Once insight is clear and consistent, the challenge becomes knowing where to focus attention next.

Insight at the right level changes the quality of the conversation.

Knowing where to focus attention

Once insight is clear and consistent, a new challenge emerges. Not everything matters equally, and the real value of insight lies in knowing where focus will have the greatest impact.

Prioritisation is where insight becomes leadership.

In practice, prioritisation means understanding where opportunity is emerging, where risk is building early, and which conversations will move the business forward.

For some, this prioritisation happens naturally through close, ongoing relationships. For others, particularly when supporting a broader client base, it needs to be systematic and process driven.

VFD was designed to support both realities.

VFD provides a structured way to assess performance, opportunity, and readiness, helping finance leaders focus their time and attention where it will make the biggest difference.

Rather than reacting to noise or relying on assumptions, this approach creates clarity around who to engage with, what to talk about, and why it matters now.

For fractional and part-time FD roles, this prioritisation often happens through deeper familiarity with fewer businesses.

For practices, it enables consistent prioritisation across a wider client portfolio.

The outcome is the same: more focused conversations and time spent where it adds most value.

With priorities clear, the next question becomes how deeply to engage, and at what frequency.

Identifying where focus will have the greatest impact across a client base.

A structured approach to assessing opportunity, risk, and readiness.

How deeply to engage, and at what frequency

Once priorities are clear, the next decision is not whether to engage, but how deeply and how often. Not every business requires the same level of financial involvement at the same point in time, what matters is that the underlying framework remains consistent.

Depth of engagement should flex. The financial framework should not.

Different businesses require different levels of financial support at different points in their journey. Some need strong foundations and control. Others benefit from structured planning and regular review. A smaller number will require deeper strategic involvement, building equity and preparing for exit.

What matters is not forcing clients into predefined service levels, but ensuring they receive the right support at the right time, using a consistent framework.

Every client should have the opportunity to be informed and educated.

From that foundation, depth of engagement evolves.

With the right frequency established, finance can operate as a true leadership function, following a clear, repeatable rhythm.

A single financial framework, tailored to each stage as businesses move through growth and transition.

A clear, repeatable financial rhythm

Effective financial leadership is not a series of isolated conversations. It follows a rhythm; a repeatable planning cycle that links insight, direction, execution, and review. VFD was designed to bring this same discipline into smaller and growing businesses, without the overhead or complexity.

Progress comes from rhythm, not reaction.

At the heart of the VFD framework sits a strategic planning cycle which provides structure and momentum over time. Rather than jumping straight into forecasts or reacting to short-term variances, the cycle creates a disciplined flow.

Understanding performance and the drivers behind it, setting direction and priorities, translating strategy into measurable expectations, and reviewing progress to stay on course and keep building momentum.

Each phase builds on the last, creating continuity and keeping activity aligned to strategic priorities. The cycle can be applied annually, quarterly, or continuously, depending on the depth of engagement required. What matters isn’t how frequently it happens, but that the approach stays consistent and strategically aligned.

The same rhythm supports strategic review, ongoing performance leadership, and longer-term value building; including preparation for exit.

Consistency turns insight into progress.

Rhythm turns progress into results.

With a clear rhythm in place, finance becomes embedded in how the business plans, acts, and evolves. Not just how it reports.

A simple, repeatable planning cycle that links insight, direction, execution, and review.

Financial Analysis

Understand performance, drivers, and constraints so decisions are well founded.

Strategic Direction

Set priorities and direction based on evidence and strategic intent.

Detailed Planning

Translate strategy into practical plans with clear metrics and accountability.

Review & Re-forecast

Monitor progress, adjust early, and keep delivery aligned to priorities.

What this enables

Taken together, the VFD framework is not about producing more information or adding complexity. It’s about creating the conditions for better financial leadership at every stage of a business journey.

By combining education, insight, prioritisation, flexible engagement, and a repeatable planning rhythm, finance moves from reacting to events to shaping outcomes.

This approach enables clearer conversations, better focus, and more confident decision-making; helping business owners understand what matters, when it matters, and why it matters now.

For finance leaders, it creates a consistent way of working, one that scales across different businesses, different stages, and different depths of engagement without losing clarity or intent.

Where many reporting tools stop at visibility, VFD is designed to support leadership, connecting numbers to decisions, decisions to action, and action to long-term progress.

The result isn’t more reporting.

It’s better decision-making, applied consistently over time.

True financial leadership is embedded in how a business plans, acts, and evolves, not just how it reports.

A short, structured conversation to clarify the right focus, the right frequency, and the right level of financial leadership.